“Despite the challenges posed by the semi-conductor shortage and the disruption caused by the COVID-19 pandemic, we have been working hard to enable more customers than ever before to fulfil their dream of owning a Porsche.” Detlev von Platen, Member of the Executive Board – Sales and Marketing

Global economy recovering

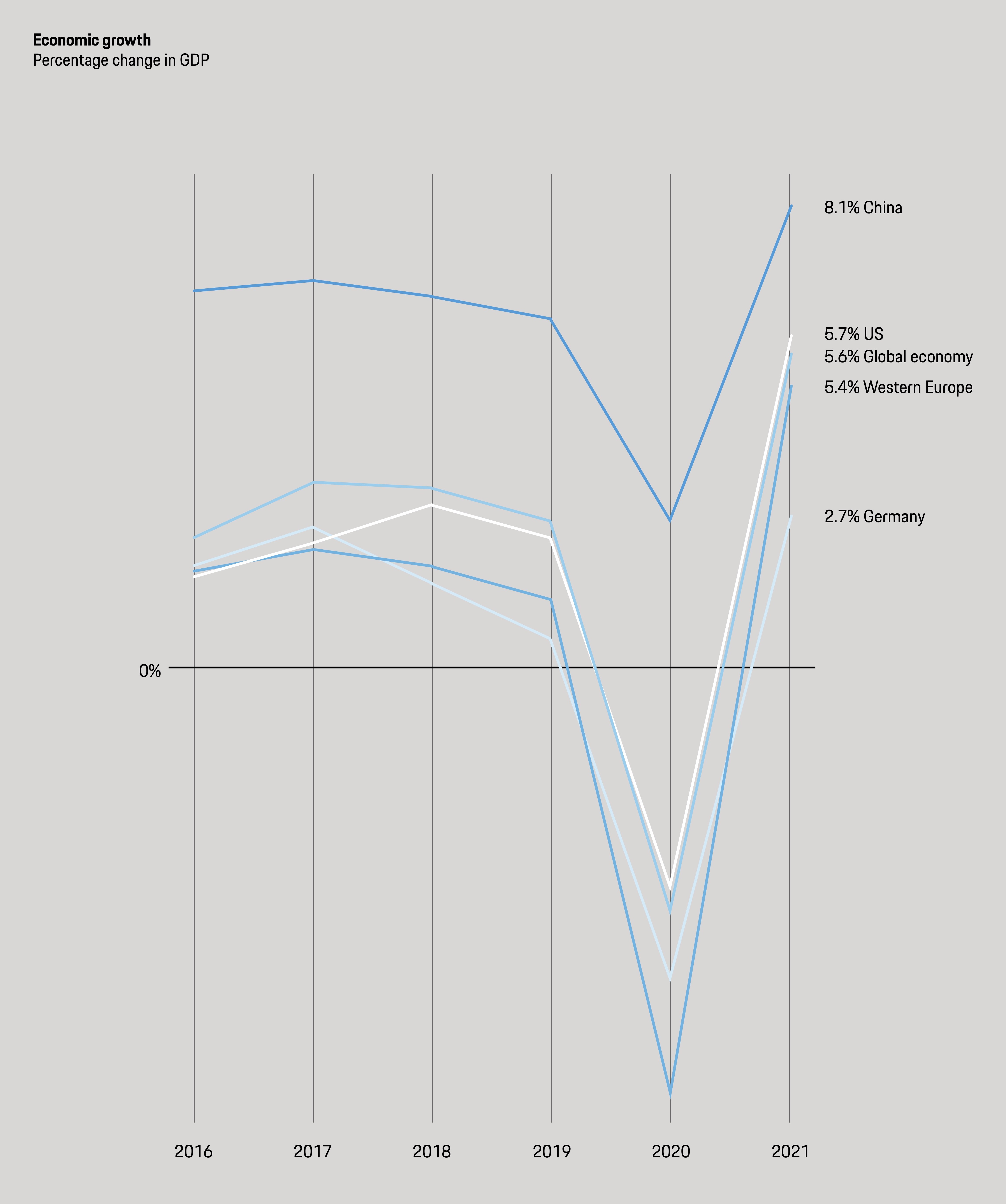

The global economy bounced back in 2021, hitting a growth rate of 5.6 per cent at the end of the year (previous year: –3.4 per cent). The average rate of growth in gross domestic product (GDP) was well above the previous year’s levels in both the developed economies and the emerging markets. Many governments took steps to curb the impacts of the pandemic and economic growth benefited from these too. For example, the progress that many countries made with vaccinating their populations had a positive effect. The prices of many energy resources and other commodities increased significantly year-on-year. Raw material and intermediate product shortages increased and consumer prices rose more quickly than in the previous year.

GDP in Western Europe increased by 5.4 per cent in 2021 (2020: –6.5 per cent). The German economy recorded growth of 2.7 per cent in the year under review (2020: –4.9 per cent). The German labour market recovered in the course of the year – the unemployment rate and the number of people on short-time work fell. Consumers and businesses alike regained their confidence. GDP in the economies of Central and Eastern Europe increased significantly too, by 5.6 per cent (2020: –2.4 per cent). Economic output increased by 6.8 per cent in Central Europe (2020: –2.1 per cent) and by 4.2 per cent in Eastern Europe (2020: –2.8 per cent). The situation in Russia was much the same, where there was an increase of 4.3 per cent (2020: –2.9 per cent).

The US economy grew by 5.7 per cent (2020: –3.4 per cent). The US administration introduced an extensive support package in the first quarter of 2021 to further bolster the economy. The Federal Reserve adhered to its low interest rate. The weekly applications submitted for unemployment support dropped and the unemployment rate fell. GDP likewise increased in the USA’s neighbouring countries – by 4.6 per cent in Canada (2020: –5.2 per cent) and by 5.5 per cent in Mexico (2020: –8.4 per cent). The Brazilian economy posted a 4.4 per cent increase in 2021 in spite of a high rate of infection (2020: –4.2 per cent). Argentina achieved growth of 8.4 per cent (2020: –9.9 per cent). China felt the negative effects of the pandemic earlier than other economies. It had already achieved economic growth of 2.3 per cent in 2020. In 2021, the Chinese government tackled isolated outbreaks with a zero-COVID strategy. The Chinese economy grew by 8.1 per cent in 2021. Japan recorded a 1.9 per cent increase in economic performance (2020: –4.5 per cent).

The global economy grew by 5.6 per cent in 2021. Of the key economic regions, China recorded the strongest growth of 8.1 per cent. Germany’s gross domestic product increased by 2.7 per cent in 2021.

Performance of car markets

The global car market increased by 4.2 per cent to 70.9 million vehicles in 2021. However, developments varied greatly in the car markets around the world, on the one hand due to the impacts of the pandemic at the regional level and on the other due to semiconductor supply bottlenecks. By the end of the year, the Asia-Pacific region had achieved growth above the global growth rate. North America and Central and Eastern Europe fell just short of the global rate. Meanwhile, there was a downward trajectory in Western Europe once again in 2021. In Germany, new registrations even fell to the lowest level since reunification.

The volume of the Western European car market dwindled to 10.7 million vehicles in the year under review – a drop of 2.0 per cent compared with 2020. However, demand for cars had already been weak in the previous year. For comparison purposes, there were 14.4 million new vehicle registrations in 2019. This downward trend was due not only to the impacts of the pandemic. In the second half of 2021 in particular, it could be attributed to the semiconductor shortage, resulting in there simply being fewer cars available. At 2.6 million units, the number of new car registrations in Germany in 2021 consequently fell 10.1 per cent short of the previous year’s weak figure. For comparison purposes, 3.6 million vehicles were newly registered in Germany in 2019. The market developments were slightly more moderate in Spain (–0.9 per cent), France (0.5 per cent) and the UK (1.0 per cent). Italy even achieved an increase of 5.6 per cent.

The market volume in Central and Eastern Europe increased by 2.8 per cent to a total of 2.9 million cars, with new registrations increasing by 1.7 per cent in Central Europe and by 3.6 per cent in Eastern Europe.

In North America, sales of passenger vehicles and light commercial vehicles (up to 6.35 tons) increased by 3.9 per cent to 17.7 million units in 2021. The US market grew by 3.4 per cent to 15.1 million units. Sales in Canada’s automobile market rose by 6.7 per cent in the reporting period, while there was growth of 6.8 per cent in Mexico. The number of passenger cars and light commercial vehicles newly registered in South America increased by 12.9 per cent to 3.5 million units.

In the Asia-Pacific region, the car market increased by 5.0 per cent to 32.7 million vehicles. A large proportion of this higher volume came from China’s car market where the number of newly registered vehicles was up 4.4 per cent year-on-year at 20.8 million. In Japan, meanwhile, the car market fell 3.2 per cent short of the previous year’s figure, at 3.7 million units.

Deliveries of new vehicles

| 2019 | 280,800 | |

| 2020 | 272,162 | |

| 2021 | 301,915 |

Deliveries: a new record

Porsche delivered 301,915 vehicles to customers around the world in the 2021 financial year, giving the sports car manufacturer a year-on-year increase of 11 per cent. All of the global sales regions contributed to this increase. Porsche recorded its biggest increase on the American continent, while China remained the biggest single market. Deliveries in Europe improved by seven per cent. There is a noticeably high level of electric sports cars in this market. Thirty-nine per cent of the Porsche vehicles delivered in this region in 2021 were electric – either plug-in hybrids or all-electric Porsche Taycan cars.

“Despite the challenges posed by the semiconductor shortage and the disruption caused by the COVID-19 pandemic, we have been working hard to enable more customers than ever before to fulfil their dream of owning a Porsche,” says Detlev von Platen, Member of the Executive Board responsible for Sales and Marketing at Porsche AG. “Demand remains high and our order books are looking very robust, so we start 2022 full of momentum and confidence in all regions of the world.”

Taycan: deliveries more than doubled

Once again in 2021, Porsche SUVs were the models in the greatest demand around the world, with 88,362 customers taking delivery of a Macan. The Porsche Cayenne followed in second place with 83,071 units delivered.

The all-electric Porsche Taycan achieved an outstanding increase – the vehicle was delivered to 41,296 customers, which equates to a more than twofold year-on-year increase. In spring 2021, the sports car manufacturer presented a second body version, the Taycan Cross Turismo. Deliveries of a third version, the Taycan Sport Turismo, will begin in spring 2022, meaning demand can be expected to continue to rise.

The iconic 911 sports car enjoyed an especially strong market reception and hit a new record of 38,464 deliveries. There were 30,220 Panamera vehicle deliveries, while the 718 Boxster and 718 Cayman models were delivered to 20,502 customers.

America

Porsche delivered 80,449 vehicles across the North American continent in the year under review. With 70,025 deliveries, the US was once again Porsche’s second largest single market worldwide. Year-on-year, 22 per cent more new vehicles were delivered to US customers.

United States: Taycan as the shooting star

Porsche delivered 80,449 vehicles across the North American continent in the year under review. With 70,025 deliveries, the US was once again Porsche’s second largest single market worldwide. Year-on-year, 22 per cent more new vehicles were delivered to US customers. Already comfortably ranked top in 2020, the Macan considerably boosted its popularity again, achieving an increase of 33 per cent in deliveries to 24,716 units. The Taycan was the shooting star in the US too. Deliveries increased more than twofold year-on-year to 9,419 units. Demand was especially high in California, with 29 per cent of the Taycan deliveries in the US going to this state in the year under review.

Canada: two pillars of success

Canada followed the very positive trend on the North American continent with an increase of 23 per cent. In total, 9,141 units were delivered in the year under review, primarily thanks to the Porsche 911 and Macan models, which both increased their prior-year delivery figures in Canada by more than 45 per cent.

Brazil: expedition with the Taycan

Plug & Charge at the Copacabana: following the market launch in November 2020, 385 Taycan units were delivered to customers in Brazil in 2021. The national roll-out of the Taycan Cross Turismo occurred in December 2021 with a special campaign – popular Brazilian sportspeople traversed 14 states in 26 days and clocked up more than 10,000 all-electric kilometres in the process. The two models with the highest delivery figures in Brazil were the Porsche 911 at 852 units and the Macan at 821 units.

Europe

A total of 86,160 vehicles were delivered to customers in Europe – seven per cent more than in 2020. Together, plug-in hybrids and the all-electric Taycan accounted for 39 per cent of deliveries in this region. “This result is promising and shows the strategy to further electrify our fleet is working and is in line with demand and the preferences of our customers,” says Detlev von Platen. The top three European markets for the Taycan were Germany (5,106 units), the UK (4,062 units) and Norway (1,714 units).

Germany: 911 remains the top seller

Demand for Porsche vehicles also increased in its home market in 2021 – Porsche delivered 28,565 vehicles to customers, equating to an increase of nine per cent. As in the previous year, the Porsche 911 was the undisputed top seller – 7,792 of this iconic sports car were handed over to customers. The models ranked in second, third and fourth place were noticeably balanced. Accounting for around 20, 19 and 18 per cent of Porsche deliveries respectively, the Macan, Cayenne and Taycan models enjoyed similar levels of popularity. In addition to the Taycan with an increase of 55 per cent, the Panamera enjoyed strong growth in Germany (12 per cent). Just under three quarters of all the Panamera units handed over to customers were equipped with a plug-in hybrid drive.

UK: ranked fourth globally

The United Kingdom of Great Britain and Northern Ireland is the fourth biggest market in the world for the sports car manufacturer based in Stuttgart. Deliveries there fell only moderately by three per cent in spite of Brexit and other challenges caused by semiconductor supplies and the coronavirus pandemic. The Taycan was the top-selling model series, with deliveries increasing 28 per cent year-on-year to 4,062 units. The popularity of the Porsche 911 likewise continued to increase, with deliveries increasing by 10 per cent. In what was undoubtedly also a result of the appeal of the product portfolio, the new 911 GT3 and the sporty 911 GTS models were rolled out in the course of the year around two-and-a-half years after the launch of the 992.

Italy: high proportion of convertibles

Porsche delivered 6,274 vehicles in Italy in 2021 – eight per cent more than in the previous year. While deliveries of the Porsche 911 remained relatively stable at 1,248 units, the delivery figures for the Taycan, Cayenne and Panamera increased in particular. There was one Taycan delivery for every two 911 units delivered to customers in 2021. In addition, Porsche customers in Italy evidently enjoy open-top driving, as Cabriolets and Targa models accounted for 44 per cent of the 718 and 911 models delivered.

France: Cayenne the most popular model

The primary successes in the French market can be summarised as follows – a sharp increase in Panamera numbers, strong Taycan growth and a slight increase in Cayenne deliveries. The Cayenne nevertheless comfortably remained the front-runner among all the model series with a year-on-year increase of four per cent to 2,371 units delivered.

Switzerland: second best result

Porsche delivered more vehicles in Switzerland in 2021 than in the year before the pandemic. A total of 3,845 delighted Swiss customers took delivery of their new sports cars. This equates to an increase of 10 per cent compared to 2020 and is the second best result since the sales company was founded. The most popular model was the Macan (1,201 units), followed by the 911 (970 units).

Austria: high proportion of electric cars

Deliveries of new cars to customers in Austria fell by around five per cent in 2021 and totalled 1,319. Increases in deliveries of the Porsche 911, Panamera and Taycan were offset by decreases in deliveries of the 718, Cayenne and Macan. Of the Cayenne and Panamera units delivered in Austria in 2021, 96 per cent respectively were plugin hybrids – one of the highest proportions in the world.

Asia-Pacific, Africa and Middle East

China: Porsche’s largest single market

Porsche delivered its first sports car to mainland China 20 years ago. China has been the company’s single biggest market since 2015. China achieved an exceptional overall result once again in 2021 with an increase of eight per cent in comparison to its previous record year, 2020. A total of 95,671 vehicles were delivered to customers in China. China was also the world’s biggest market for the Cayenne, Panamera and Macan model series. One in three Macan units delivered around the world in 2021 went to a Chinese customer. Female buyers of the compact SUV accounted for just under 60 per centof purchases.

Taiwan: upturn thanks to the Taycan

There was a four per cent increase in deliveries to more than 4,000 in Taiwan in 2021. As in many other markets, the Taycan played a significant part in growth in Taiwan. Taycan units accounted for around one in five Porsche vehicles delivered in Taiwan in 2021, with Taycan deliveries totalling 802. Only the Cayenne and the Macan sold in greater numbers, with 1,390 and 980 deliveries respectively.

South Korea: Taycan in second place

With 8,425 vehicle deliveries in South Korea last year, there was a seven per cent increase in new Porsche ownership there. The Taycan, which was rolled out in South Korea at the end of 2020, was one of the success factors – the electric sports car immediately shot to second place with 1,288 units delivered, behind the Cayenne on 3,480 units. The 718 mid-engine model series was relatively low in comparison at 632 deliveries, but this still represented a 30 per cent increase in South Korea.

Japan: Macan the most popular

Following record deliveries in 2020, three per cent fewer Porsche vehicles were handed over to customers in Japan last year (6,900 units). The Macan was the top model in terms of deliveries in the year under review with 2,109 vehicles delivered, followed by the previous year’s front-runner, the 911 (1,529 vehicles). The Taycan was rolled out in Japan in January 2021 and 784 customers took delivery of their all-electric sport saloon in 2021.

Middle East: significant increase

Porsche delivered a total of 5,374 new vehicles in the Middle East – a year-on-year increase of 14 per cent. The Arab Gulf countries had a comfortable lead in the region in terms of volume (4,427 deliveries) and outstripped their prior-year result by 15 per cent. There were also exactly 333 Taycan models delivered to customers in the Arab Gulf countries.

Africa: promising outlook

Porsche recorded a total of 1,817 deliveries in Africa last year. This is equivalent to a decrease of five per cent compared with 2020. South Africa was the biggest single market on the continent, with 875 new Porsche vehicles being delivered to customers there in 2021.

Australia: successful start for the Taycan

Porsche Cars Australia celebrated a milestone anniversary in 2021 – 70 years previously, the company officially imported the first two Porsche 356 models there, laying the foundations for the brand’s presence in Australia. In this anniversary year, deliveries were up four per cent year-on-year at 4,431 vehicles (2020: 4,243 Porsche vehicles). Approximately one in two Porsche models delivered in Australia was a Macan. In the year it was introduced in Australia, the Taycan accounted for 531 deliveries to customers.

Outlook

According to our forecasts, economic growth in Western Europe will strengthen significantly in 2022. This will also be true for Germany. We are expecting gross domestic product in Germany and in Western Europe as a whole to generally outperform 2019, the last year not to be affected by the pandemic. In the car markets in Western Europe as a whole and in Germany, we expect to see a noticeable increase in new registrations in 2022.

Global economy on a growth path

Our planning is based on the assumption that global economic output will continue to grow on the whole in 2022. We believe that the effects of the pandemic can be sustainably stemmed. We also assume that the shortages of intermediate products and raw materials will be overcome in 2022. We consider protectionist tendencies, potential turbulence on the financial markets and structural deficits in some countries to be a source of risk. At the same time, growth prospects are being kept in check by ongoing geopolitical tension and conflict. Nevertheless, we believe that both developed economies and emerging markets will register positive movements in economic output. We also expect to see continued growth in the global economy in the years 2023 to 2026.

According to our forecasts, economic growth in Western Europe will strengthen significantly in 2022. This will also be true for Germany. We are expecting gross domestic product (GDP) in Germany and in Western Europe as a whole to generally outperform 2019, the last year not to be affected by the pandemic. We are also forecasting growth in Central and Eastern Europe, albeit with slightly less momentum in Eastern Europe and in the Russian economy.

We are anticipating relatively strong economic growth in the US in 2022. The Federal Reserve has offered the prospect of rising interest rates in the course of the year – albeit at a low level. How inflation continues to develop is an important factor regarding potential prime rate increases. We expect to see a significant increase in economic output in Canada too, while we are anticipating more moderate growth rates in Mexico. The same goes for Brazil. According to our forecasts, the Chinese economy will continue to grow. And in Japan, economic output is likely to enjoy solid growth in 2022.

Performance of car markets

Our forecasts indicate that there will be slightly different performance trends in the car markets in the various regions of the world in 2022. Overall, we expect to see a moderate increase in new vehicle sales globally. However, this is premised on the pandemic being successfully contained and the shortages of intermediate products and raw materials being overcome. We expect demand for passenger vehicles to grow globally in the years 2023 to 2026 too.

We are forecasting a noticeable increase in new vehicle registrations in Western Europe this year. Semiconductor supply bottlenecks will likely continue to weigh heavily on the car market. We nevertheless expect the number of new car registrations in Germany to be significantly up year-on-year in 2022. In the UK and Spain too, we expect to see significant increases in 2022. According to our forecasts, the car markets in France and Italy will grow slightly. We expect to see noticeably higher numbers of new registrations in Central and Eastern Europe.

In the markets for passenger vehicles and light commercial vehicles (up to 6.35 tons) in the US and in North America as a whole, we expect new registrations to be slightly up year-on-year in 2022. However, demand for vehicles in the SUV and pick-up segments can be expected to remain high. We are forecasting moderate growth in Canada’s and Mexico’s car markets. The South American car markets are dependent on global demand for raw materials and are heavily influenced by how the global economy develops. We expect new registrations to increase considerably in 2022 in South America as a whole and in the largest countries, Brazil and Argentina.

Passenger car markets in the Asia-Pacific region are expected to be slightly above the previous year’s level in 2022. Our forecasts suggest that China’s market volume will likewise be slightly above the figure for 2021. The market in Japan is expected to improve considerably in 2022.

-3.jpg)